Thursday, October 29, 2015

New Public Fleet EV and Public Workplace EV Charging Station Incentive Program

DEEP is pleased to announce that funding is now available for municipalities and state agencies to receive funding for fleet electric vehicle (EV) purchases in conjunction with workplace charger installation.

Municipalities and state agencies can demonstrate leadership and their commitment to market development of zero emission vehicles (ZEV) through the purchase of EVs and the installation of EV charging stations for their workplace. The goal of this program is to support ongoing efforts towards putting 3.3 million EVs on the road by 2025.

Utilizing funds made available through the Regional Greenhouse Gas Initiative, DEEP will provide a reimbursement of $15,000 per EV and $10,000 per charger meeting the program guidance specifications, to a maximum of six EVs and chargers per grant recipient!

Specific details about this exciting new program and other great EV incentives can be found at www.EVConnecticut.com. All inquiries regarding this program should be directed to Lakeisha Christopher, Lakiesha.Christopher@ct.gov. The closing date for applications is Tuesday, December 8 at 5:00 pm.

Labels:

Alternative Fuels,

Electric Vehicle,

energy,

EVs,

EVSE,

funding,

grant,

Incentives,

ZEVs

Friday, October 2, 2015

Propane School buses: Better for students, schools, & the environment

Learn the basics of how propane autogas school buses are better for students, schools, and the environment. The video touches on the differences between diesel and propane school buses. Propane school buses have better emissions, great safety measures, have less maintenance, and are cost effective. Propane as a fuel is American made, abundant, and available everywhere creating energy security for the nation. Children, parents, school bus operators, and school boards that have made the switch love propane buses.

Labels:

Alternative Fuels,

Autogas,

Propane,

Safety,

School Buses

Friday, September 4, 2015

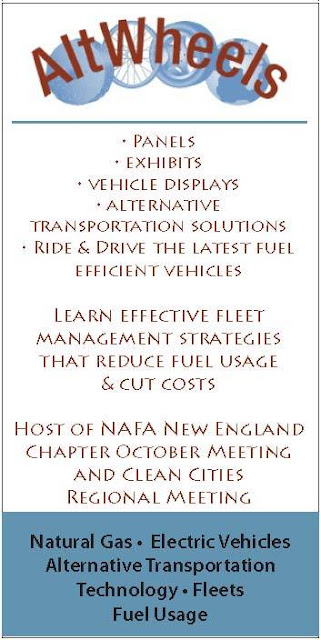

AltWheels Fleet Day

AltWheels Fleet Day is the largest meeting of corporate and

municipal Fleet Managers on the East Coast. Come see and hear the latest in

fleet transportation technologies, alternative fuels and fleet management

practices.

The day consists of panels, exhibits, and vehicles offering a

showcase of alternative transportation solutions — from concept vehicles, to

vehicles that are available and affordable today. This year's Fleet Day will be

hosted at the Four Points by Sheraton hotel and conference center on Route 1 in

Norwood, MA in their state-of-the-art conference space with a large outdoor

vehicle display.

Register at http://www.altwheels.org.

Labels:

Alternative Fuels,

Biodiesel,

CNG,

Electric Vehicle,

Ethanol,

Events,

Fuel Cell Vehicle,

Hydrogen,

LNG,

Propane

Monday, August 17, 2015

IRS Notice 2015-56 Deductibility of Alternative Fuel Tax Credits

The Internal Revenue Service (IRS) in Notice 2015-56 provides guidance for taxpayers on the proper treatment of deductions relating to tax credit claims for sales or use of alternative fuel. The Tax Increase Prevention Act of 2014 (enacted December 19, 2014) made the $0.50 alternative fuel credit retroactive for calendar year 2014. In January 2015, the IRS issued guidance in Notice 2015-3 requiring that all claims relating to the alternative fuel credits must be filed using Form 8849 and that these claims must be submitted by August 8, 2015.

The notice issued this week indicates that taxpayers must treat the tax payments as if they had offset their tax liability in 2014 even though under notice 2015-3 the 2014 claims were required to be taken as a single payment and not as an offset for 2014 tax liability. In previous years, the normal practice was to claim the credit first as an excise tax offset against the federal excise tax on the alternative fuel and then to claim any excess credit as a payment. The notice indicates that taxpayers must reduce their “excise tax liability for each calendar quarter during the 2014 calendar year by its alternative fuel credit attributable to alternative fuels sold or used during the calendar quarter.” Thus, they must treat the credits as if they had been taken against 2014 tax liability. Companies who have claimed the fuel credit for 2014 activities relating to an alternative fuel and who paid excise tax on an alternative fuel for 2014 activities should review the notice with tax counsel and determine how to proceed. The full notice is available on the IRS website.

The notice issued this week indicates that taxpayers must treat the tax payments as if they had offset their tax liability in 2014 even though under notice 2015-3 the 2014 claims were required to be taken as a single payment and not as an offset for 2014 tax liability. In previous years, the normal practice was to claim the credit first as an excise tax offset against the federal excise tax on the alternative fuel and then to claim any excess credit as a payment. The notice indicates that taxpayers must reduce their “excise tax liability for each calendar quarter during the 2014 calendar year by its alternative fuel credit attributable to alternative fuels sold or used during the calendar quarter.” Thus, they must treat the credits as if they had been taken against 2014 tax liability. Companies who have claimed the fuel credit for 2014 activities relating to an alternative fuel and who paid excise tax on an alternative fuel for 2014 activities should review the notice with tax counsel and determine how to proceed. The full notice is available on the IRS website.

Labels:

Alternative Fuels,

biofuels,

Natural Gas,

Propane,

Taxes

Friday, July 24, 2015

Question of the Month: What are the latest updates on hydrogen and fuel cell electric vehicle deployment?

Answer:

|

| Toyota's Fuel Cell Vehicle, the Mirai, available for lease in certain areas of the country. |

Fuel cell electric vehicles (FCEVs) have been around for a while, mostly in limited quantities and locations through demonstration projects. But these vehicles, with their potential to significantly cut petroleum consumption and reduce emissions, are starting to make their way into dealerships and onto roads across the country. Though the market for FCEVs is still in its infancy, many government organizations and private companies are working on research and deployment efforts to make hydrogen a widespread, viable, affordable, and safe alternative vehicle fuel.

Below are some of the recent activities related to FCEV commercialization:

Vehicle Availability

FCEVs are beginning to enter the consumer market in certain regions in the United States and around the world. Hyundai introduced the 2015 Tucson Fuel Cell in California last year for lease, and Toyota Motor Company announced they will release the 2016 Mirai for sale this October at eight California dealerships that were specially selected for their experience with alternative fuels and their proximity to existing hydrogen fueling stations. Vehicle original equipment manufacturers (OEMs) such as BMW, Ford, General Motors, Honda, Mercedes/Daimler, Nissan, and Volkswagen are expecting to launch FCEV production vehicles in select regions of the country in the coming years. Other automakers continue to introduce their FCEVs through demonstration projects. The FCEV market is also growing for buses, ground support equipment, medium- and heavy-duty vehicles, back-up power, prime power applications, and continues to be strong for forklifts.

While OEMs are offering affordable lease options, some of which include the cost of fuel, FCEVs are still expensive. However, production costs have decreased significantly in recent years and FCEVs are expected to be cost-competitive with conventional vehicles in the coming years.

Hydrogen Fueling Infrastructure

As the FCEV market expands, hydrogen fueling infrastructure will need to grow to match demand. Most of the hydrogen stations available today have been built to support OEM FCEV demonstration projects. According to the Alternative Fuels Data Center's (AFDC) Alternative Fueling Station Locator (http://www.afdc.energy.gov/fuels/hydrogen_locations.html), there are 12 publicly accessible hydrogen stations in the United States, with many more in the planning stages. According to the California Fuel Cell Partnership (http://cafcp.org/), there are 49 more stations in development in California that will be publically available. Development efforts are also underway in Connecticut, Hawaii, Maine, Massachusetts, New Jersey, New York, Rhode Island, and Vermont.

Like the vehicles, the high cost of fueling equipment remains a key challenge. Hydrogen station costs can vary significantly based on hydrogen feedstock, station capacity, utilization, proximity to production, and available incentives. The National Renewable Energy Laboratory's (NREL) Hydrogen Station Cost Calculator estimates that stations can cost between $2 and $5 million. However, like FCEVs, as the demand grows, the cost of hydrogen fueling equipment will decrease and the number of stations will increase.

Codes, Standards, and Incentives

The widespread deployment of FCEVs and the associated network of hydrogen fueling stations requires the development, maintenance, and harmonization of codes, standards, and regulations to keep up with the technology. These efforts are ongoing and are supported by the U.S. Department of Energy (DOE), as well as domestic and international organizations.

Incentives will also continue to be important to promote and maintain a market for hydrogen and FCEVs. California is leading in the number of relevant state incentives. For instance, to meet the objectives of California's Zero Emission Vehicle (ZEV) Program, the California Energy Commission's Alternative and Renewable Fuel and Vehicle Technology Program (http://www.energy.ca.gov/drive/) is allocating $20 million annually for the construction of at least 100 public hydrogen stations in California by January 1, 2024. In addition, California's Clean Vehicle Rebate Project offers up to $5,000 for the purchase or lease of approved FCEVs (http://energycenter.org/clean-vehicle-rebate-project). Nine other states (Connecticut, Maine, Maryland, Massachusetts, New Jersey, New York, Oregon, Rhode Island, and Vermont) have also adopted California's ZEV mandate to increase the number of ZEVs, including FCEVs, on the roads.

Ongoing Research and Development

Significant research and development efforts by DOE, the national laboratories, and other H2USA partners have brought the hydrogen industry to where it is today (http://energy.gov/eere/fuelcells/accomplishments-and-progress). Through their Fuel Cell Technologies Office (http://energy.gov/eere/fuelcells/fuel-cell-technologies-office), DOE continues to support research in the areas of hydrogen production, delivery, and storage, as well as technology validation, manufacturing, and market transformation.

Additional Resources

- AFDC's Hydrogen page (http://www.afdc.energy.gov/fuels/hydrogen.html) provides basic information on hydrogen, FCEVs, and the associated infrastructure.

- AFDC's Alternative Fuel and Advanced Vehicle Search (http://www.afdc.energy.gov/vehicles/search/) allows users to look for available FCEVs.

- H2USA, a public-private partnership to promote hydrogen and FCEV commercialization and adoption, maintains a FCEV page (http://h2usa.org/fuel-cell-electric-vehicles).

- NREL's Fuel Cell and Hydrogen Technology Validation page (http://www.nrel.gov/hydrogen/proj_tech_validation.html) includes evaluation and performance review data on various FCEVs in a real-world setting, as well as hydrogen station performance, maintenance, cost, and safety data.

- NREL's report, Hydrogen Station Cost Estimates (http://www.nrel.gov/docs/fy13osti/56412.pdf) outlines the costs associated with hydrogen fueling stations.

- Argonne National Laboratory's Hydrogen Refueling Station Analysis Model (HRSAM;http://hydrogen.energy.gov/h2a_delivery.html) can be used to calculate the cost of hydrogen stations.

- NREL's Hydrogen Financial Analysis Scenario Tool (H2FAST; http://www.nrel.gov/hydrogen/h2fast/) can also provide useful information on the cost of hydrogen stations.

- DOE's website (http://energy.gov/eere/fuelcells/safety-codes-and-standards) covers relevant safety, codes, and standards.

- AFDC's Hydrogen Laws and Incentives page (http://www.afdc.energy.gov/fuels/laws/HY) is a searchable tool with information on state regulations and incentives pertaining to hydrogen.

Clean Cities Technical Response Service Team

800-254-6735

Labels:

Alternative Fuels,

EVs,

FCVs,

Fuel Cell Vehicle,

Hydrogen,

ZEVs

Tuesday, July 21, 2015

CT DEEP Releases Hydrogen Fueling Infrastructure Grant Solicitation

|

| A public hydrogen station in Wallingford, CT. |

The Department of Energy and Environmental Protection (DEEP), in partnership with the Connecticut Center for Advanced Technology, Inc. (CCAT), is pleased to announce that funding is now available for a "Hydrogen Refueling Infrastructure Development" (H2Fuels Grant) Program to promote the use of FCEVs, reduce air pollution and move us closer towards meeting our long term climate change targets. CCAT will award up to $450,000 to qualified vendors to establish, operate and maintain two hydrogen fueling stations in or near Hartford, Connecticut.

All information can be found at evconnecticut.com.

Labels:

Alternative Fuels,

energy,

Hydrogen,

Incentives

Wednesday, July 15, 2015

CT DEEP host a Workplace Charging Workshop

Monday, August 3, 2015

8:00 a.m. - 1:00 p.m.

The Hartford, 690 Asylum Avenue, Hartford, CT

Advanced Registration is Required.

More information and the agenda are located at the CT Department of Energy and Environmental Protection EVConnecticut website.

Labels:

Alternative Fuels,

Electric Vehicle,

Events,

EVs,

EVSE

Thursday, June 11, 2015

Electric Vehicle Showcase at Cheshire's Strawberry Festival & Antique Show

Labels:

Clean Cities,

Electric Vehicle,

Events,

EVs,

EVSE,

ZEVs

Monday, June 1, 2015

Electric Vehicle Charger Station Incentives

DEEP announced another round of funding for Electric Vehicle Supply Equipment (EVSE) or electric vehicle charging stations.

Funds are made available for municipalities, state agencies and private businesses to install EV chargers, that significantly reduce the cost of the initial cost of these chargers.

Funding varies based on the selection criteria for the program as some projects are eligible to receive a maximum of $10,000.

To get started, visit EVConnecticut - Charger Incentives from there choose your category of either private business or municipalities/state agencies.

The application due date for private businesses is June 30th.

The application due date for municipalities and state agencies is July 21st.

Labels:

Alternative Fuels,

Electric Vehicle,

EVs,

EVSE,

funding,

grant,

Incentives,

ZEVs

Wednesday, May 20, 2015

New CT Incentive to Buy or Lease an Electric Vehicle

Up to $3,000 cash rebate for CT residents, businesses, & municipalities who purchase or lease an electric or fuel cell vehicle.

The program is funded by $1 million that Connecticut received from approving the 2012 merger between NSTAR and Northeast Utilities, the combined company now called Eversource Energy. In total $800,000 will be used for the cash rebates and $200,000 will be used to provide incentives to the salespeople at dealerships that sell the vehicles.

This builds on the state's EVConnecticut initiative that has provided grants to install about 160 electric chargers that must be available to the public free of charge and has also partnered with the Connecticut Automotive Retailer's Association to award dealerships that sold or leased the highest number of EVs.

Table 1. CHEAPR rebates based on the electric vehicle battery size.

Gov. Malloy's press release about the CHEAPR program

Program Details

Labels:

Electric Vehicle,

EVs,

EVSE,

FCVs,

Fuel Cell Vehicle,

funding,

Incentives,

ZEVs

Monday, April 20, 2015

Electric Vehicle Rate Rider Pilot to Mitigate High Demand Charges

|

| Electric vehicle charging stations have different charging capacities. The DC fast chargers require a high demand of electricity in a little amount of time creating a costly demand charge. |

In Connecticut more and more Direct Current (DC) fast charging stations are being deployed along state highways as a solution to charge an electric vehicle while away from home. However due to their size, these fast charging stations are placed on a commercial rate that includes both energy and demand-based billing components. Since these stations operate at their full capacity for only short periods of time, they need to only be used by one electric vehicle customer to hit their peak demand.

The Connecticut Light and Power Company (CL&P) requested an Electric Vehicle Rate Rider Pilot (EVRRP) as a solution to mitigate the high demand charges. This will allow for a more rapid deployment of fast charging stations by the State of Connecticut and will allow CL&P to gather data more quickly regarding issues surrounding public charging stations, including their use levels, rates, and technology. The data will be shared and will help guide the Public Utilities Regulatory Authority's (PURA) ultimate decision on the appropriate rate for electric vehicles.

Under the EVRRP, a customer would be billed for electric service during a given month on the basis of: (a) the monthly customer charge, (b) the equivalent per kWh charges for the demand-related portions of the distribution, transmission and competitive transition assessment (CTA) components of service, and (c) on a per kWh basis for all other charges specified under the applicable rate schedule. CL&P proposed to bill pilot participants for DC fast charging on the pilot rate, derived from the standard rate applicable to the rest of the load of the facility where the station is located, which is separately metered.

You can read the complete docket here.

Labels:

Electric Vehicle,

EVs,

EVSE,

policy,

Regulations

Tuesday, March 17, 2015

Funding Opportunity: Assist in the Purchase of Clean Fuel Vehicles and Diesel Retrofit Technologies | Due April 30

| |||

|

Tuesday, March 10, 2015

Municipal and State EV Charging Incentive Program

| |||

| |||

|

Wednesday, February 11, 2015

Indianapolis CNG Refuse Truck Fire Update

|

| A Compressed Natural Gas (CNG) refuse truck. |

The Clean Vehicle Education Foundation (CVEF) has released an update related to its investigation of the Indianapolis CNG refuse truck fire. The update contains a review of the incident as well as safety recommendations for drivers and first responders faced with a CNG vehicle fire.

Print or save the information in a PDF.

Indianapolis CNG Refuse Truck Fire Update

On January 27, 2015, two CNG cylinders ruptured while

firefighters in Indianapolis, Indiana were fighting a refuse truck fire that

appears to have started in the truck’s hopper. The CNG cylinders on this truck

were located in the area above the hopper. While the investigation is far from

complete, the Clean Vehicle Education Foundation (CVEF) wishes to alert

operators of CNG vehicles and first responders to some important facts.

A common procedure in such trash fires is to dump the load

so that it can be extinguished on the pavement. This was not done in the

Indianapolis incident, but it should always be considered wherever possible.

The fire in the trash hopper exposed the CNG fuel system mounted

above the hopper roof to intense heat. Prolonged, direct, and intense heat can

damage the structural integrity of CNG cylinders, ultimately resulting in a

rupture if pressure is not relieved.

The fuel system was equipped with pressure relief devices

(PRDs) mounted at both ends of each cylinder. The PRDs are designed to relieve

pressure in CNG containers in the event of a fire threat. The fire continued

for more than 30 minutes from initial detection prior to a cylinder rupture.

There is no evidence so far that these temperature-activated devices

experienced sufficient heat input to trigger and relieve the gas pressure. The

PRDs were designed and qualified in accordance with the ANSI PRD1 standard for

CNG PRDs.

It has been recognized that PRDs cannot always activate in

time to prevent any chance of a cylinder rupture in a fire. ANSI PRD1 contains

the following quote from the older CGA S-1.1 standard for industrial gas PRDs.

CGA S-1.1, Pressure Relief Device Standards Part 1-Cylinders

for Compressed Gases states: “relief devices may not prevent burst of a

cylinder under all conditions of fire exposure. When the heat transferred to

the cylinder is localized, intensive, and remote to the relief device, or when

the fire builds rapidly, such as in an explosion, and is of very high

intensity, the cylinder can weaken sufficiently to rupture before the relief

device operates, or while it is operating.”

CNG cylinders are almost always equipped with protective

covers that make it difficult to spray water directly on the cylinders. Direct

or indirect water sprayed on the system in Indianapolis may have kept the PRDs

below their intended trigger temperature. Another recent and very similar

refuse truck fire resulted in relief of pressure through the PRDs as intended,

but in that case the firefighters cleared the area and allowed the truck to

burn without attempting to cool the cylinder package, possibly changing the

outcome.

Recommendations:

Drivers and first responders should receive specific

training for handling a CNG vehicle fire.

If the burning cargo can be dumped or a burning trailer can

be disconnected, that should be done as soon as the fire department is

summoned.

Since in most CNG vehicle fires it is too late to save the

vehicle by the time the cylinders are threatened, fire fighters should clear a

safe perimeter and not try to approach the vehicle to fight a fire that is

threatening the cylinders unless there are injured people to evacuate.

The cylinder enclosure should not be sprayed with water

unless the PRDs will not be cooled or the gas has already been vented through

PRDs.

Based on previous fires, firefighters should not approach a

burning CNG vehicle directly from either end or side. They should approach on

about a 45-degree angle.

Specific instructions should be obtained from the vehicle

manufacturer, upfitter, or converter when dealing with the aftermath of a CNG

vehicle fire. Some of the cylinders may have been relieved during the fire but

others might remain full and will require following special procedures to empty

them.

The Clean Vehicle Education Foundation will participate in

the ongoing investigation and report on additional findings and recommendations

as needed. Contact John Dimmick at jdimmick.cvef@gmail.com or Doug Horne at

dbhorne1@gmail.com if you have any questions.

The Clean Vehicle Education Foundation makes great effort to

provide secure, accurate and complete information. However, portions of the

information contained in this document may be incorrect or not current. Any

errors or omissions should be reported to dbhorne@cleanvehicle.org for

investigation. The Clean Vehicle Education Foundation, it's officers, employees

or agents shall not be liable for damages or losses of any kind arising out of

or in connection with the use or performance of the information provided

herein, including but not limited to, damages or losses caused by reliance upon

the accuracy or timeliness of any such information, or damages incurred from

the viewing, distributing, or copying of those materials. The information provided in this document is

provided "as is." No warranty of any kind, implied, expressed, or

statutory, including but not limited to the warranties of non-infringement of

third party rights, title, merchantability, or fitness for a particular

purpose, is given with respect to the contents of this document.

Monday, January 26, 2015

IRS gives guidance and deadline for alternative fuel incentives for 2014

Notice 2015-3 issued on January 16, 2015 provides taxpayers the process to make a one time claim for alternative fuels sold or used in the 2014 calendar year. Claims may be filed as early as January 16, 2015 but the official start date is February 9, 2015 and need to be completed by August 8, 2015. The Notice provides detailed information on how the 2014 claims are required to be filed. Claims will require using Schedule 3 of Form 8849, Claim for Refund of Excise Taxes. The taxpayer must claim the full amount using one single claim.

First time claimants who are not registered must file Form 637, Application for Registration, prior to making claims for credits. Persons intending to file the claim should seek advice from tax counsel or an accountant.

Labels:

Alternative Fuels,

Biodiesel,

biofuels,

Incentives,

RFS,

Taxes

Monday, January 5, 2015

Energy Independence Summit 2015

Energy Independence Summit 2015

February 22-24, Washington, DC

Please join us at the nation's premier alternative fuels policy summit, where the nation's Clean Cities Coalitions and transportation energy leaders share best practices and educate federal policy makers about key strategies to overcome barriers to the widespread use of cleaner vehicles and fuels.

This year the event will be at the Washington Court Hotel on 525 New Jersey Ave NW, a short walk from United States Capitol.

Come January, the 114th Congress will be sworn into office. The 2015 summit presents a tremendous opportunity to inform new members of Congress about alternative energy projects in their districts that are creating jobs and contributing to energy independence in America.

Highlights of the 2015 Summit include:

- Washington insiders will share knowledge on how the new Congress will shape prospects for federal funding and incentives to promote alternative fuels, vehicles and infrastructure.

- Senior federal agency officials from the Departments of Energy, Transportation, Defense, Agriculture, and EPA will discuss funding opportunities and policies to encourage increased use of alternative fuels.

- State and local leaders will showcase innovative state and local policies and programs, which are advancing markets for cleaner fuels and vehicles;

- Top transportation energy industry leaders will describe new technologies and market developments that are driving the alternative fuels industry forward.

- On Capitol Hill Day, Clean Cities Coordinators and our industry partners will participate in more than 200 meetings with Congressional and federal agency officials. The day will culminate with a reception hosted by UPS and attended by key Members of Congress and staff.

If you have any questions regarding the Energy Independence Summit 2015 please contact Lee Grannis at lgrannis@snet.net or call Lee at 203.627.3715.

Labels:

Alternative Fuels,

Clean Cities,

DC,

EIS 2015,

energy,

Events,

policy

Subscribe to:

Comments (Atom)